Regional Loan Center Contact Information - VA Home Loans - Questions

The smart Trick of Nevada Military Bases History And Locations - National VA That Nobody is Discussing

VA loans *, used through Greater Nevada Home loan, are part of a mortgage loan program developed by the United States Department of Veterans Affairs to assist veterans and their households acquire home funding. To receive a VA loan debtors should provide a certificate of eligibility, which develops their record of military service, to the loan provider, and veterans can utilize their advantage several times.

* All loans undergo credit approval by Greater Nevada Home Mortgage. Extra conditions use. For a representative payment example, click here..

Nevada Home is Possible for Heroes Program - Military Benefits

The Ultimate Guide To VA Approved Condos in Las Vegas, NV - Highrises.com

This short article and its content is solely for educational functions only. VAMortgage, Center is a registered trademark of Home loan Research Center, LLC. (NMLS # 1907) and not available in Nevada. With the typical listing cost of a house in Nevada landing at $608,348, the VA loan's signature $0-money-down benefit is a considerable benefit for Nevada property buyers.

Allegiance Home Lending

HENDERSON, NV - Quick Short-Term Payday Loans - Near Me Payday Loan

Due to the fact that personal loan providers make the loans and not the VA, you need to find a loan provider certified in the state you prepare to buy or refinance. For example, if you're purchasing a home in Las Vegas, NV, you'll need to discover a lending institution licensed in Nevada to do the loan.

The Of Mortgage Pre-Licensing - Nevada Mortgage Renewal - Official

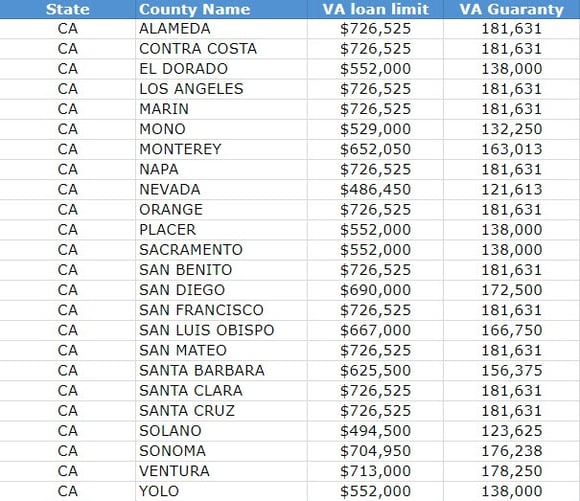

Nevada VA Loan Limits Since January 1, 2020, VA customers in Nevada with their complete VA loan entitlement are not limited by VA loan limits. This indicates you can borrow as much as a lending institution is willing to lend without requiring a down payment. However, veterans without their full VA loan entitlement are still bound to Nevada's VA loan limitations.

Real Estate Tax in Nevada Another factor to consider for VA buyers in Nevada is property taxes. For certain VA buyers, there are exemptions. Learn More Here may be qualified for a property tax exemption in Nevada if you meet among the list below conditions: Disabled veterans with a disability score in between 60 to 79 percent are qualified for a $10,000 deduction.

The Definitive Guide for Nevada FHA Loans - Nevada VA Loans - Nevada

If you are needed to pay property tax in Nevada, the American Community Study by the U.S. Census Bureau approximates you might pay the following in each county: How VA Loans Work in Nevada View the graphic listed below to find out more about how VA loans operate in Nevada.